What is an Invoice? The Ultimate Guide to Invoicing

Content

Whether you are creating and sending hundreds of invoices a month or just a few each year, DocuSign has a solution to make invoicing easier. To get started with creating digital invoices, sign up for a DocuSign free trial. However, requesting the customer’s signature on an invoice is a common practice.

- This allows everyone to trade and offer any goods or services to customers right from a smartphone during their coffee break.

- This type of invoice is most commonly used in export sales but there are other opportunities to take advantage of it.

- An invoice should clearly display the seller’s contact information.

- It details what goods have been provided, or what work has been done, and how much must be paid in return.

- An invoice may serve as a preliminary estimation of services to be executed.

- Let’s say a construction company is working on a long-term project, they’ll likely send interim invoices instead of waiting until the end to bill the client.

The first signatures and seals appeared on invoices made of animal skin, papyrus, and, finally, paper. All these features served as a means of protection and confirmed the genuineness of the document. The age of “paper supremacy” is still not over, yet the document flow is becoming more and more digitalized. Businesses assign invoice numbers in sequential or chronological order and by project or customer ID. Assigning numbers by project ID is common in construction industries. So skip using informal and one-off receipts and start documenting your invoicing properly — you can’t afford not to.

The Basics of an Invoice

The invoice date indicates the time and date the Supplier officially records the transaction and bills the client. The invoice date is a crucial piece of information, as it dictates the payment due date and credit duration. Generally, the due date is 30 days following the invoice date.

All invoices must contain contact information for both parties. This doesn’t need to be long, but it should include enough information so the customer can easily identify what they are paying for. Make sure to include quantities and amounts, as this can be an area of invoice dispute that leads to delayed payments. Additionally, invoices will help protect your business in the event of an audit. It shows the IRS exactly where your money comes from should they question your tax returns.

Types of Invoices

Add your company logo to customise your invoice and promote your unique brand. It is sent to a customer prior to the delivery of goods or services. It describes what the seller will provide, the price that will be charged, and several related https://www.bookstime.com/articles/what-is-an-invoice items. This document can be used to ensure customer agreement with the amount that will eventually be billed through a regular invoice. It is also used for documentation purposes when shipping goods across international borders.

What do you mean by invoice?

An invoice is an itemized commercial document that records the products or services delivered to the customer, the total amount due, and the preferred payment method.

©contrastwerkstatt /Adobe Stock

So you’re wondering exactly what is an Invoice? The term “invoice” gets thrown around a lot, but can be confusing at first to understand. Trying to learn more about how a BMO Harris business account can help you? Let’s look at the key features, fees, account types, alternatives. An invoice and a bill are essentially the same, seen from different perspectives. Once the customer receives the invoice, it becomes a bill that they must pay.

What Is an Invoice and What Does It Mean in Business?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Does an invoice mean you’ve paid?

Does an invoice mean you've been paid? An invoice does not indicate that a business has been paid for goods or services provided to its customers. An invoice is created to notify the customer that they need to pay for the good or service they received.

An invoice number should be assigned to each invoice you issue. This reference number establishes a paper trail of information for you and your customers’ accounting records. Assign invoice numbers sequentially so that the number on each new invoice is higher than the last.

What Is an Invoice ID?

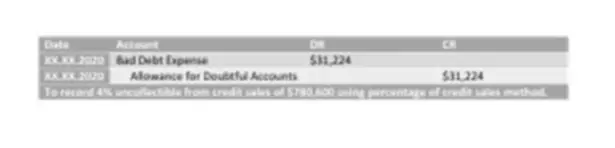

It is an estimation invoice that notifies the client of estimated costs for the project. In most instances, invoices are generated for credit or delayed payment transactions, most likely a B2B transaction. There could be a request for a quotation or tendering process. Once the purchaser matches the specifications of the product or service with their requirements, they issue a purchase order. A debit invoice is issued when a business needs to increase the amount a client owes for a service or product. Proforma invoices are issued to a customer before a product or service is delivered.

Is an invoice a bill or receipt?

Once the customer pays you, generate a receipt acknowledging the payment. On the flip side, if you are a customer, the invoice you receive from the supplier is your bill, and once you pay your bill, you will get a receipt.

Invoices may seem like a familiar document, but there is more to them than many realize. Read on to learn everything you need to know about invoices, including what invoices are, how to write them, and how digital invoices can benefit your business. You may also include a copy of an invoice for more convenience. Join the 50,000 accounts receivable professionals already getting our insights, best practices, and stories every month. Here are three best practices we recommend for streamlining the invoicing process for both you and your customers. While these steps should be adhered to for all invoicing methods, electronic invoicing helps streamline the process for faster payment collections.

If this rings true for your business, this step is simplified. An example of invoice payment terms might be “Net 30”, meaning the customer has 30 days to pay from the date of issue. An invoice due date calculator can help ensure your customers are abiding by payment terms. Invoices are a vital part of the accounting and cash flow audit process and are regularly used in business transactions.

- You also need to make sure that you get paid on time by your clients.

- This is easy to do with Square Invoices, which lets you create and send invoices straight from the Square invoicing app on the spot.

- If you are a business owner creating an invoice, you will want to use a professional invoice template.

- The age of “paper supremacy” is still not over, yet the document flow is becoming more and more digitalized.

- Creating correct and professional invoices can also make a big difference to getting paid on time.

- A finalized invoice establishes an obligation that the client pays the business for products or services that have been rendered.

This section will also outline by which method the seller prefers to receive their payment, which could be by check, ACH, bank transfer, or credit card. Clean audit trails are important for finance teams, especially for tax filing purposes. Having a record of all invoices issued and collected makes it easier for businesses to report their income. Dedicated invoicing software can help you keep a record of all your invoices. Our easy-to-use invoice templates make it simple to create professional invoices in just a few clicks.

reasons for issuing invoices

Historically, invoices have been recorded on paper, often with multiple copies generated, so the buyer and seller each have a transaction record. Some companies choose to offer clients discounts for early settlement or payment in advance. Increasingly, small-to-medium businesses (SMBs) are going further to protect themselves from late payment, and are asking for invoices to be settled within as little as seven days.