A new age for energy and commodity trading

Online brokers who offer markets in the same energy products make the trading of energy markets more user-friendly. They take a live price feed from the exchange but offer their clients a cash-only product which can be traded in small sizes. The oil and refined products traded on futures exchanges are financially settled and physically delivered. Many futures contracts provide the option to exchange the financially settled instrument for a physical transaction delivered to an ICE-regulated storage facility. This reflects the futures exchange primarily serving the ‘real’ economy – people who want to take delivery of a quantity of crude as part of their business model. Investments in oil and gas projects are projected to stay stable in absolute terms.

- The «Locational» refers to the clearing price at a given point on the grid (we’ll get to why prices are different at various locations in a moment).

- These companies know how to manage their financial energy risks and have the risk-management skills that will be deployed increasingly in the emerging global environmental markets.

- Depending on the energy trading forms, P2P energy trading mainly includes thermal, electrical, and hydrogen energy systems.

- On the demand side, commonly referred to as a load, the main factors are economic activity, weather, and general efficiency of consumption.

- Crude oil, coal, and gas (fossil fuels) can be extracted from the earth — they are formed from the build-up of dead organisms including plants and animals subjected to pressure and heat for over a million years.

- Grid reliability and balancing are operated by Regional Transmission Operators (RTO).

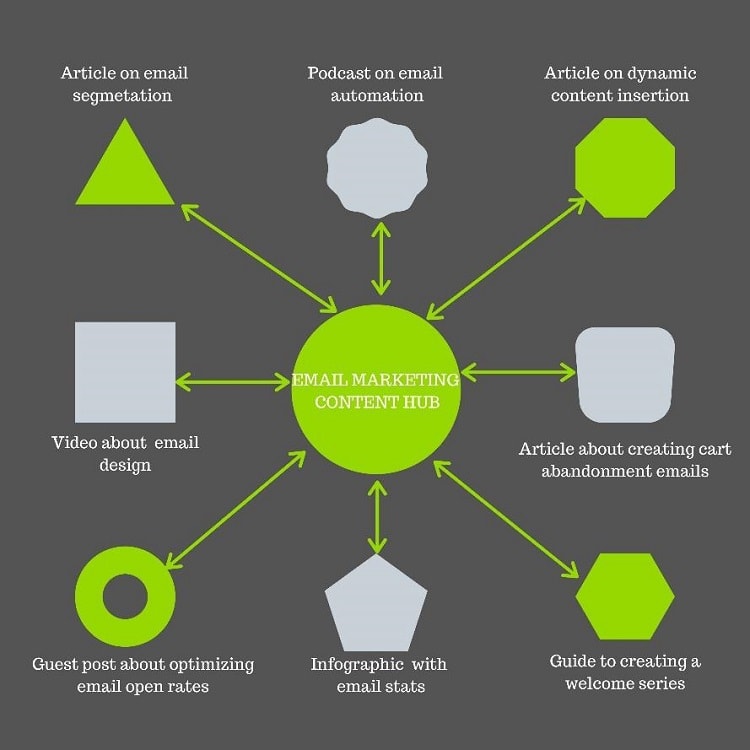

Each ETF outlines products it might invest in, such as futures contracts, indices that track the movement of some underlying asset, or energy stocks. Today, exchange trade in energy resources is one of the most promising areas of investment activity for many participants of the trade process in various commodity markets around the world. This class of assets is a set of different energy carriers such as oil, natural gas, electricity, etc., which nowadays are of great value within the economic system of one particular state and the whole world. Energy systems are becoming more decentralized, with large-scale power plants replaced by small-scale renewable energy producers (Exhibit 2). Most smaller-scale companies lack the financial means, risk appetite, and capabilities to manage the marketing of their production, exposure to volatile power prices, and the hedging of future production.

Evaluation of the Trade-offs from Regional Coal Development and Environmental Strategies

Turning on a 50-watt light bulb for 20 hours uses one kWh of electricity. The move to cleaner energy is a substantial underlying influence on the market as it is backed by the world’s governments. 1 For example, the Dutch title transfer facility (TTF) gas market is increasingly connected to the Asian LNG Japan/Korea Marker (JKM) spot Bolsas asiaticas gas market. Asktraders is a free website that is supported by our advertising partners. As such we may earn a commision when you make a purchase after following a link from our website. India and other developing countries in Africa, Asia, and the Middle East will need factories to manufacture goods, supply metals, and machines.

Shyam Metalics & Energy share price Today Live Updates : Shyam Metalics & Energy stocks slump in trading today – MintGenie

Shyam Metalics & Energy share price Today Live Updates : Shyam Metalics & Energy stocks slump in trading today.

Posted: Wed, 06 Sep 2023 09:22:52 GMT [source]

Natural gas is widely traded, but it’s less fungible than crude oil since it is a gas. Dubai is the Asian benchmark for Middle East crudes as approximately 1.7 million barrels per day of crude this crude oil is produced making it a reliable benchmark. This includes European and Asian Gasoil (which is heating oil), as well as jet fuel and naphtha. Electrical power and renewable energy are sectors that are continuing to expand. The IEA sees renewable energy accounting for half of the rise and natural gas for 35%. Traders keen to capitalise on the projected future growth of the energy market should also be wary of the volatility that affects this sector.

Energy CFDs

The cost of heating and cooling our homes, factories, hospitals, businesses, and schools is determined by our energy consumption. The «Locational» refers to the clearing price at a given point on the grid (we’ll get to why prices are different at various locations in a moment). The «Marginal» means that the price is set by the cost of delivering one more unit of power, usually one megawatt. The lack of storage and other more complex factors lead to very high volatility of spot prices.

Second, markets are trading in real time more than ever; for example, power and gas can now trade in slots of only 10 minutes in a number countries compared with daily a few years ago. As a result, companies are rolling out new intraday trading teams and algorithmic models to cope with this new market structure. First, energy markets in particular are becoming more globally interconnected. https://investmentsanalysis.info/ For example, LNG prices are increasingly connecting major global gas markets to each other1. Similarly, European power and gas trading hubs are increasingly correlated from north to south and west to east, progressively transforming what used to be to a collection of local trading hubs into a more regional market. Electricity is a local product that is actively traded in the United States.

2 Characteristic 2: Risk Management, Optimization, and Trading are Essential Parts in the Operation of a Utility

Faced with challenging tasks in life, I have developed the habit of thinking rationally and creatively to solve problems, which not only helps me develop as a person, but also as a professional. Speaking about my professional activities, I can say that I have always been attracted to the study of foreign languages, which later led me to the study of translation and linguistics. We have identified three new strategies to promote trading income growth. According to Bloomberg, electricity demand will increase by 25% by 2050 to 38,700 terawatt-hours from 25,000 terawatt-hours in 2017. About 1.3 billion of the world population have no access to power – this includes about one-third of Indian’s population.

These energy commodities are traded in the futures market but can also be traded on OTC markets as forward contracts. Energy ETFs and stocks of energy companies are also traded on the equity market. Energy trading began in 1978 with the first oil futures contract on the New York Mercantile Exchange (NYMEX).

Case Studies of Solar Forecasting with the Weather Research and Forecasting Model at GL-Garrad Hassan

Additionally, a high penetration of DERs raises operational and market challenges such that existing incentives and tariff support cannot be sustained with penetration growth at the microgrid level. As a result, some competitive market mechanisms or P2P models are required at the local distribution level. In Ref. [7], a matching mechanism is proposed to allow individual generators and load units to meet to conduct a bilateral trade. Each unit interested in maximizing its benefit adopts its own bid strategy. Trade between a randomly matched generation and load unit is established if their bids are compatible, which does not require the units to share their private cost or value information.

Enbridge bets big on US gas with $14 billion bid for Dominion utilities – Reuters.com

Enbridge bets big on US gas with $14 billion bid for Dominion utilities.

Posted: Tue, 05 Sep 2023 23:56:00 GMT [source]

The EIA believes that by 2040 there will be 330 million electric cars on the road up from an estimate of 300 million in 2018. In the coming decades, India and other emerging countries will have to trade power grid infrastructures as their economies begin to show positive growth. This development will increase the demand for industrial energy which could offset the ebbing demand from industries in developed countries. The predicted flat growth for energy in developed nations is not because their economic conditions are bad rather they will benefit from greater energy efficiency in the long run.

Is Energy Supply Rising or Falling?

Most of us are familiar with fossil fuels like gasoline and diesel, but the energy market goes well beyond transportation. In addition to fossil fuels, the energy market also incorporates natural gas liquids, electrical power, nuclear power, and renewable energy. These power generators will need some form of fuel like natural gas, crude oil, coal, and non-renewables to function. As the access to power expands to more countries across the world, energy demands are bound to increase. Smart grid technology, more efficient natural gas-fired power plants, and fuel-efficient cars are some of the positive innovations that could bring about a new revolution in energy efficiency. The most fascinating unknown fact is how far or to what length these innovations can advance or how they might be a game-changer in the consumption shares of renewable energy to non-renewable energy.

The possibility of any credit risks is excluded, as SICOM acts as a counterparty in each transaction. The first three levers focus on promoting growth in trading; the last two describe fresh approaches to drive efficiency. Heads of trading business units and chief commercial officers should actively pursue these levers to sustain margin growth in light of strong competition and rapidly evolving markets. The DOE sees natural gas production averaging 89.8 BCF per day down 3% year over year from 92.2 BCF per day. Global oil growth demand is expected to increase into the 2030s and then begin to decelerate.

They can reduce the price of electricity by increasing the supply of electricity and reducing the demand for fossil fuels. Furthermore, private generation by renewables (e.g., roof-top solar panels on a home) can be sold back to the grid in many cases, in what is known as net metering. Many states offer tax incentives to homeowners who take steps to make their homes more sustainable and energy-efficient. These are early steps that allow retail customers to participate in the wholesale energy market. The long-term aim is a more efficient and lower-cost model that benefits consumers and producers alike.

What is the wholesale electricity market, and how does it work?

They can either be traded on a formal exchange, such as the Chicago Mercantile Exchange (CME), or on an over-the-counter (OTC) basis. The changes to supply and demand for energy globally presents an opportunity to trade these markets. Shocks generally generate price spikes or troughs, which eventually recover. Several strategies can be used to trade energy products, including evaluating supply and demand, measuring one energy product versus another, as well as using technical analysis. The encouragement of localized energy trading within a distribution network at low voltage levels promotes an eBay-like market platform and P2P models.